What Are The Tax Brackets By Age . 10%, 12%, 22%, 24%, 32%, 35%, and 37%. there are seven federal income tax rates in 2022: Sample sizes at higher ages are small. Here we outline the 2023 tax brackets and You pay tax as a percentage of your. in 2024, there are seven federal income tax rates and brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 10%, 12%, 22%, 24%, 32%, 35% and 37%. the average rate is just the ratio of tax liability to agi. earned income — income you receive from your job (s) — is measured against seven tax brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the federal income tax has seven tax rates in 2024: Taxable income and filing status determine which. see current federal tax brackets and rates based on your income and filing status.

from www.freidelassoc.com

earned income — income you receive from your job (s) — is measured against seven tax brackets: in 2024, there are seven federal income tax rates and brackets: there are seven federal income tax rates in 2022: the federal income tax has seven tax rates in 2024: You pay tax as a percentage of your. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Here we outline the 2023 tax brackets and see current federal tax brackets and rates based on your income and filing status. the average rate is just the ratio of tax liability to agi. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

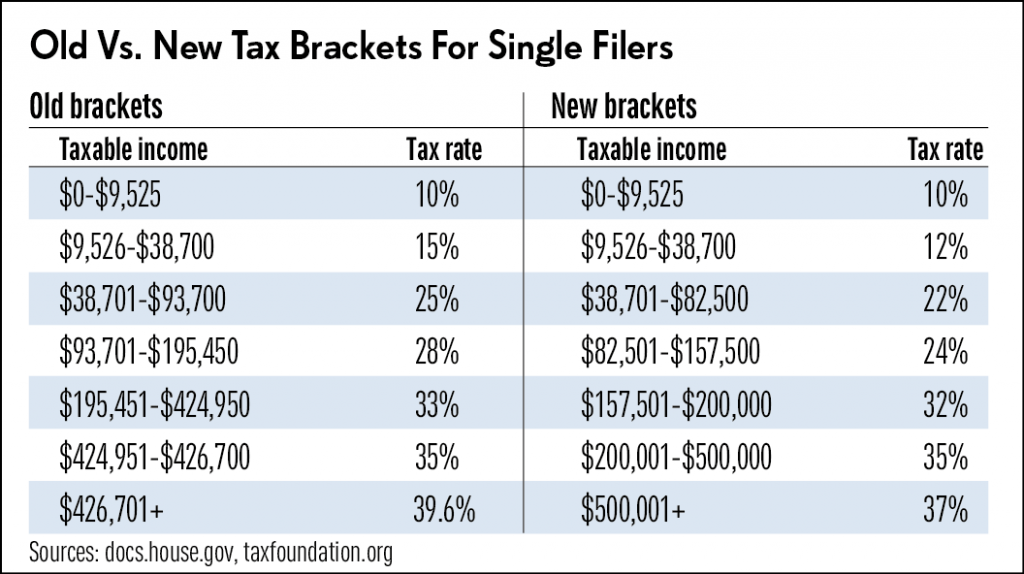

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel

What Are The Tax Brackets By Age You pay tax as a percentage of your. earned income — income you receive from your job (s) — is measured against seven tax brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the federal income tax has seven tax rates in 2024: You pay tax as a percentage of your. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. in 2024, there are seven federal income tax rates and brackets: see current federal tax brackets and rates based on your income and filing status. Taxable income and filing status determine which. there are seven federal income tax rates in 2022: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Here we outline the 2023 tax brackets and the average rate is just the ratio of tax liability to agi. Sample sizes at higher ages are small. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

From www.athenscpa.net

Tax Brackets Explained Seymour & Perry, LLC Athens CPA What Are The Tax Brackets By Age You pay tax as a percentage of your. see current federal tax brackets and rates based on your income and filing status. the average rate is just the ratio of tax liability to agi. the federal income tax has seven tax rates in 2024: Taxable income and filing status determine which. in 2024, there are seven. What Are The Tax Brackets By Age.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know What Are The Tax Brackets By Age there are seven federal income tax rates in 2022: Taxable income and filing status determine which. earned income — income you receive from your job (s) — is measured against seven tax brackets: the average rate is just the ratio of tax liability to agi. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Sample sizes at higher. What Are The Tax Brackets By Age.

From www.financestrategists.com

Taxes Ultimate Guide Tax Brackets, How to File and How to Save What Are The Tax Brackets By Age 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. in 2024, there are seven federal income tax rates and brackets: Here we outline the 2023 tax brackets and there are seven federal income tax rates in 2022: see current federal tax brackets and rates based on your income and filing status.. What Are The Tax Brackets By Age.

From thecollegeinvestor.com

2019 Federal Tax Brackets What Is My Tax Bracket? What Are The Tax Brackets By Age in 2024, there are seven federal income tax rates and brackets: Here we outline the 2023 tax brackets and the average rate is just the ratio of tax liability to agi. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. see current federal tax brackets and rates based on your income. What Are The Tax Brackets By Age.

From austincarr.pages.dev

What Are The Tax Brackets For 2025 And 2025 Tax Year Austin Carr What Are The Tax Brackets By Age 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. see current federal tax brackets and rates based on your income and filing status. in 2024, there are seven federal. What Are The Tax Brackets By Age.

From www.researchgate.net

Age Bracket Distribution of Respondents Download Scientific Diagram What Are The Tax Brackets By Age see current federal tax brackets and rates based on your income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Taxable income and filing status determine which. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the average rate is just the ratio. What Are The Tax Brackets By Age.

From www.youtube.com

Know which tax bracket you fall in based on your YouTube What Are The Tax Brackets By Age see current federal tax brackets and rates based on your income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the average rate is just the ratio of tax liability to agi. Sample sizes at higher ages are small. the federal income tax has seven tax rates in. What Are The Tax Brackets By Age.

From penelopegill.pages.dev

What Are The Tax Brackets For 2025 Uk Penelope Gill What Are The Tax Brackets By Age Here we outline the 2023 tax brackets and the federal income tax has seven tax rates in 2024: there are seven federal income tax rates in 2022: Taxable income and filing status determine which. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Sample sizes at higher ages are small. 10 percent, 12 percent, 22 percent, 24 percent, 32. What Are The Tax Brackets By Age.

From www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2024 Rates What Are The Tax Brackets By Age Here we outline the 2023 tax brackets and Sample sizes at higher ages are small. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. You pay tax as a percentage of your. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. the federal income tax has seven tax rates in 2024: the average. What Are The Tax Brackets By Age.

From ansleybermentrude.pages.dev

What Are The New Tax Brackets For 2024 Darcie Laverne What Are The Tax Brackets By Age 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the federal income tax has seven tax rates in 2024: Taxable income and filing status determine which. Here we outline the 2023 tax brackets and there are seven federal income tax rates in 2022: earned income — income you receive from your. What Are The Tax Brackets By Age.

From www.freidelassoc.com

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel What Are The Tax Brackets By Age earned income — income you receive from your job (s) — is measured against seven tax brackets: Here we outline the 2023 tax brackets and Taxable income and filing status determine which. 10%, 12%, 22%, 24%, 32%, 35% and 37%. see current federal tax brackets and rates based on your income and filing status. the federal income. What Are The Tax Brackets By Age.

From tax-alt.com

TaxBracketsand2018changes Taxalternatives What Are The Tax Brackets By Age earned income — income you receive from your job (s) — is measured against seven tax brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the federal income tax has seven tax rates in 2024: . What Are The Tax Brackets By Age.

From boxden.com

Oct 19 IRS Here are the new tax brackets for 2023 What Are The Tax Brackets By Age 10%, 12%, 22%, 24%, 32%, 35% and 37%. there are seven federal income tax rates in 2022: Here we outline the 2023 tax brackets and see current federal tax brackets and rates based on your income and filing status. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. in 2024, there are seven federal income tax rates and. What Are The Tax Brackets By Age.

From www.wgrz.com

IRS changing tax brackets, standard deductions going up in 2023 What Are The Tax Brackets By Age the average rate is just the ratio of tax liability to agi. Taxable income and filing status determine which. the federal income tax has seven tax rates in 2024: there are seven federal income tax rates in 2022: see current federal tax brackets and rates based on your income and filing status. 10 percent, 12 percent,. What Are The Tax Brackets By Age.

From www.cwa.tax

Tax Brackets CWA TAX PROFESSIONALS What Are The Tax Brackets By Age 10%, 12%, 22%, 24%, 32%, 35% and 37%. You pay tax as a percentage of your. see current federal tax brackets and rates based on your income and filing status. earned income — income you receive from your job (s) — is measured against seven tax brackets: Sample sizes at higher ages are small. Taxable income and filing. What Are The Tax Brackets By Age.

From msassociates.pro

WHAT ARE THE DIFFERENT TAX BRACKETS? Msa What Are The Tax Brackets By Age 10%, 12%, 22%, 24%, 32%, 35% and 37%. there are seven federal income tax rates in 2022: the average rate is just the ratio of tax liability to agi. the federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. earned income. What Are The Tax Brackets By Age.

From www.techkee.com

How your tax bracket could change in 2018 under Trump’s tax plan, in 2 What Are The Tax Brackets By Age the federal income tax has seven tax rates in 2024: Taxable income and filing status determine which. see current federal tax brackets and rates based on your income and filing status. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. earned income — income you receive from your job (s) — is measured against seven tax brackets: . What Are The Tax Brackets By Age.

From www.mdtax.ca

Tax Brackets for Ontario Individuals 2017 and Subsequent Years MD What Are The Tax Brackets By Age see current federal tax brackets and rates based on your income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Sample sizes at higher ages are small. You pay tax as a percentage of your. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. in 2024, there are seven federal. What Are The Tax Brackets By Age.